Japan’s iGaming market presents a promising arena for live dealer software to flourish. But for providers seeking to tap into this lucrative market, it’s crucial to have a clear understanding of player expectation, cultural preferences and local internet infrastructure.

In this market research report, we look at live dealer games in Japan. Drawing upon TESTA’s crowdtesting-powered benchmarking, we aim to equip providers with the knowledge necessary to navigate Japan’s iGaming opportunities.

This report examines the current state of live dealer games in Japan, explores market projections, and explains the test methodologies used to get the live dealer load time benchmarks. It also offers actionable insights to help providers optimize their offerings for maximum market penetration and player satisfaction.

Live dealer games are gaining popularity across Asia, especially in Japan, where strong gaming culture and advanced technology provide ideal conditions for these platforms.

Japan’s unique blend of technology and gaming enthusiasm, high-speed internet, and digital connectivity set high standards for game performance and reliability. This being the case, a clear understanding of the market, with crowd tested live dealer player experiences, is a competitive advantage.

Success in Japan’s iGaming market relies on sophisticated integrations between providers and operators, and optimizing streaming and interactivity to meet Japanese players’ standards. These characteristics have been noted in other markets, as TESTA previously observed in its market report on Ontario’s live dealer game market. Providers aiming for this market need to prioritize player experience to minimize churn and boost retention.

The rise of live dealer games in Japan is a testament to its leading role in shaping Asia’s online gambling future. Adapting to Japanese player preferences will be crucial for providers aiming for a lasting impact. Recent data from IMARC Group show that the Japanese online gambling market reached a value of USD 7.7 billion in 2023, and is poised to reach USD 12.6 billion by 2032.

Background: state of live dealer games in Japan

Market projection

Japan is a technologically advanced nation with a well-established middle class. As one of the pre-eminent iGaming markets in Asia, TESTA has previously conducted performance surveys of Japan’s top 10 fastest slot games in Q2 2023. While gambling laws are strict in Japan, flexible interpretation of the law has given rise to legal pachinko, horse racing industries, and online gambling.

Owing to Japan’s status as perhaps one of the largest markets of gacha games, there exists a great overlap in appetite for many forms of iGaming experiences. This familiarity with in-app purchases positions Japanese users as a primed demographic for embracing online casinos and live dealer software of all stripes.

The island nation features robust technological infrastructure with some of the fastest internet speeds in Asia, making it an ideal environment for bandwidth-intensive live dealer software. However, the advanced infrastructure coupled with high technological penetration rates have also set player experiences regarding fluidity in streaming and interactivity for betting, challenging providers with better optimization in order to compete on the market.

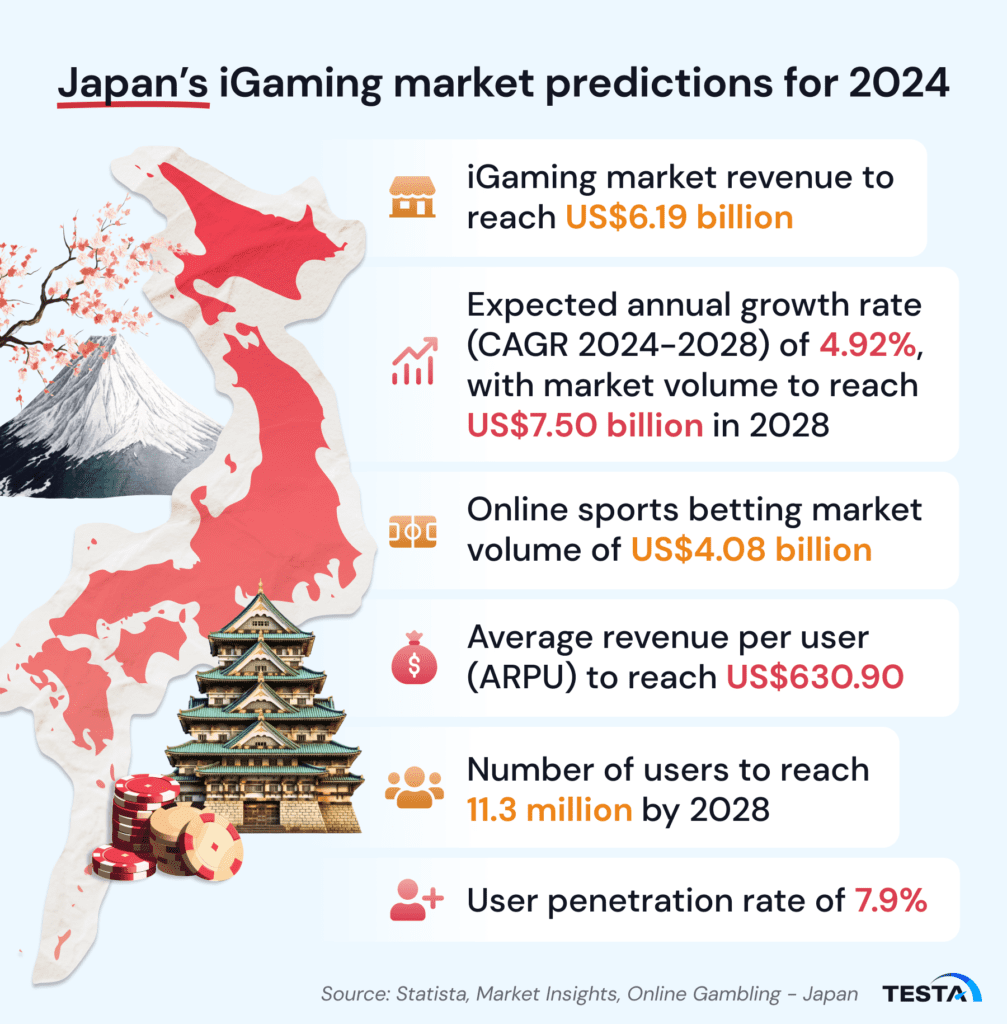

- Market size: Revenue in Japan’s online gambling market is projected to reach US$6.19 billion in 2024, showcasing a promising starting point.

- Growth potential: Market analysts predict a steady growth rate, with a Compound Annual Growth Rate (CAGR) of 4.92% between 2024 and 2028. This could push the market volume to US$7.50 billion by 2028.

- Focus on sports betting: Online sports betting is expected to be a major driver of this growth, with a projected market volume of US$4.08 billion in 2024.

- User engagement: The average revenue per user (ARPU) in Japan’s online gambling market is estimated to be around US$630.90 in 2024. With a projected user base of 11.3 million by 2028, and a current user penetration rate of 7.9% in 2024, there’s room for significant expansion as regulations evolve.

(Source: Statista, Market Insights, Online Gambling – Japan)

Test method and results

Japan’s top live dealer game providers:

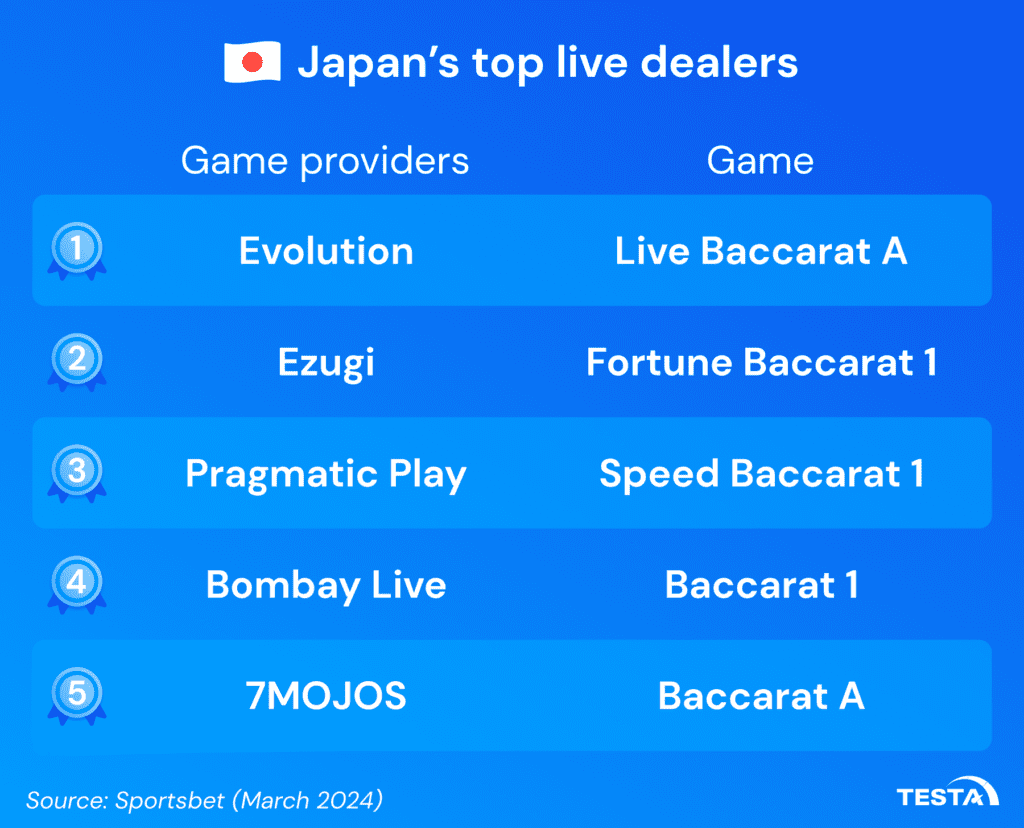

According to the ranking from the online casino website sportsbet.io, these games are the top 5 live dealer games in Japan. TESTA collaborated with its local Qrowd testers in Japan, delegating testing tasks specifically for these games. Subsequently, all gathered data is centralized and sent back to TESTA for comprehensive analysis.

Test setup

- Each tester was asked to conduct test assignments on their own devices.

- All tests conducted were video recorded and sent back alongside collected data.

- Testers were asked to:

- Enter the online casino website sportsbet.io

- Login to their account

- Search for the top live dealer games on the website with the region filter set to Japan

- Measure the game load time

Once each tester completed their assignment, they send the collected data and recorded video footage back to TESTA for analysis.

Test parameters: live dealer game load time

For this test, we are solely interested in finding out how long it takes for the games to load. Since the test platform is a website, the load time calculates how long it takes from clicking on a title on the search page to the point at which the user connects to the live stream successfully.

Load time plays a pivotal role for iGaming titles as it impacts both player engagement and retention. Long load times tend to directly correlate with high player churn. To facilitate a smooth experience for players, load times should ideally be as short as possible.

Test data: live dealer game benchmark results for Japan’s online casinos

Best game load time (seconds):

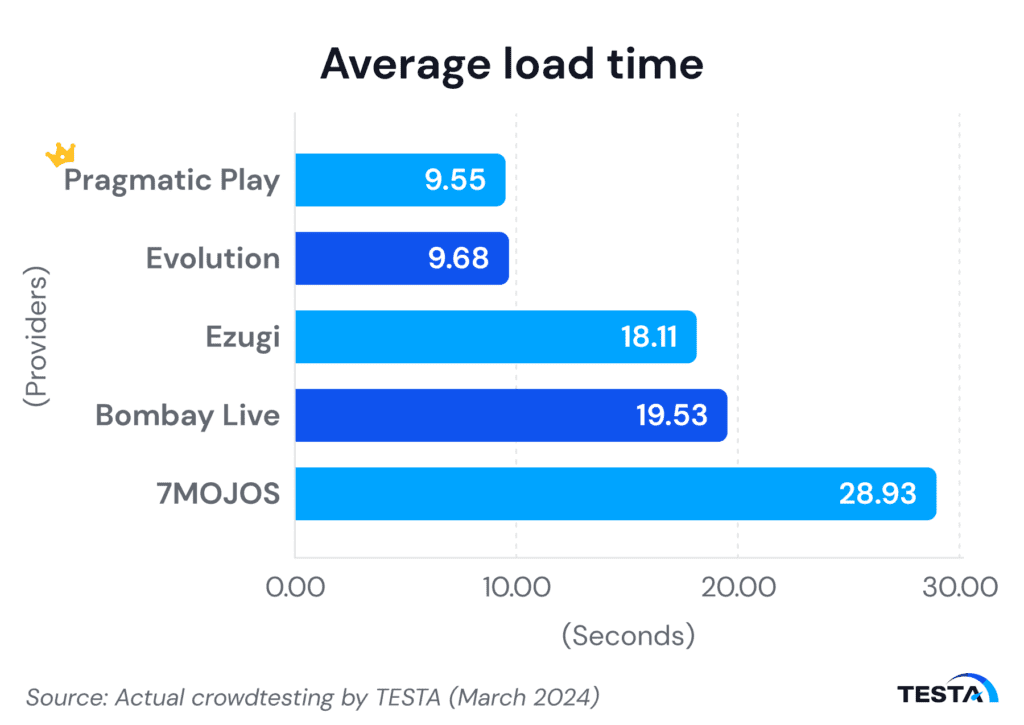

- Pragmatic Play’s Speed Baccarat 1 with 9.55 sec

Most in need of optimization:

- 7MOJO’s Dragon Tiger with 28.93 sec

The average game load time in Japan came in at 17.16s. For reference, the fastest contender among the tested Asian countries was South Korea at 9.46s, followed by Thailand in second place with 13.88s. It seems that despite Japan’s reputation for being a technologically advanced country, issues such as rural-urban divides still exist when it comes to internet infrastructure.

Studies by the Ministry of Internal Affairs and Communications (MIC) in Japan show that while most households have access to broadband internet, the quality and availability of high-speed connections like fiber optic can be lower in rural areas. This translates to slower download speeds and longer game load times for rural players.

Furthermore, Japanese rural areas typically have fewer cell towers compared to urban centers. This can lead to weaker signal strength and slower data speeds, impacting game load times for those using mobile connections. Therefore, providers entering the Japanese live dealer market should be especially aware of the range of internet speeds that exist and implement bandwidth adaptive technologies like dynamic video bitrate compression as needed.

Conclusion

Robust market research is the cornerstone for businesses aiming to thrive amidst fierce competition. Crowdtesting market research is especially useful as it provides on-the-ground insights into user experiences through performance metrics like game load times. TESTA’s crowdtesting model, notable for its effectiveness and affordability, presents iGaming providers with a strategic advantage in understanding and penetrating the Japanese iGaming market.

Elsewhere, successful providers like Playgon’s Vegas Lounge, tailor to local preferences and leverage internet capabilities to deliver seamless home-based experiences.

The performance analysis of live dealer games in Japan presented in this report shows TESTA’s commitment to providing actionable data through its network of Qrowd testers. By leveraging this wealth of information, iGaming companies can fine-tune their offerings to align with Japanese player expectations. As a trusted partner in the iGaming sector, TESTA extends its support further through a suite of free-to-access market research reports, empowering providers to navigate the complexities of the Japanese market with confidence.

If you are interested in getting even more detailed market insights or customized solutions to benefit your iGaming business:

- Contact us: Experience first-hand how TESTA’s crowdtesting can benefit your iGaming operations.

- Find us on LinkedIn: Share the insights you’ve gained from TESTA’s analysis across the industry.

- Read more articles: Stay informed about the latest trends and benchmarks in iGaming.